Move beyond being a transactional service provider, to a trusted financial partner

Marketers in the financial sector face a unique and complex set of challenges due to the highly regulated nature of the industry, intense competition, evolving customer expectations, and the intangible nature of financial products. Consumers are accustomed to highly personalised experiences, so marketers need to balance the desire for personalised marketing with strict data privacy regulations and growing consumer concerns about how their data is used. Apteco can help marketers in the financial sector to learn more about their customers, so that they can provide engaging, tailored communications, proactive assistance, and seamless interactions.

Apteco can help you to segment your customers based on demographics, like financial behaviour or life events (marriage, new home, retirement) to help deliver highly personalised messages, product recommendations and advice that resonates with individuals and leads to higher engagement and conversion.

Effectively manage and leverage your data while adhering to strict privacy rules to meet the evolving customer expectations for digital and personalised experiences. Apteco offers granular access control, allowing you to define who can access what data and at what level.

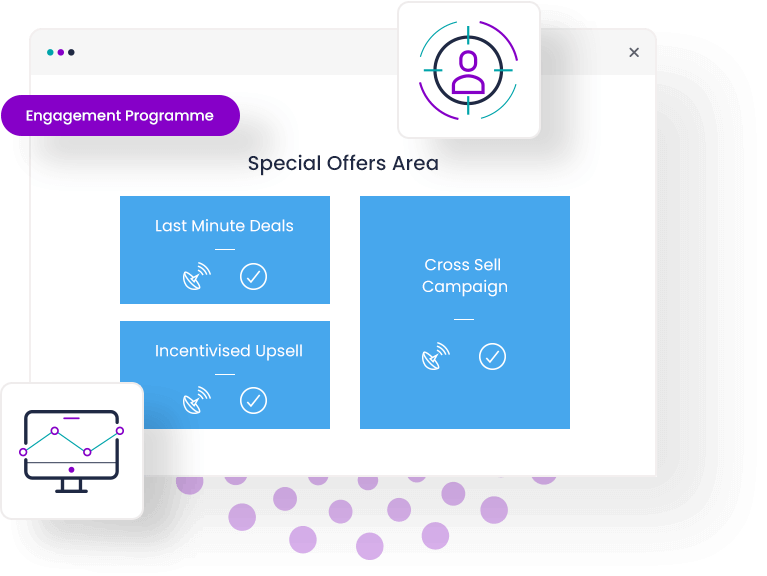

It's significantly more cost-effective to retain existing customers, than to acquire new ones. And loyal customers are also more likely to refer others and engage with more of your products, increasing their lifetime value. Apteco can help you to foster loyalty, encourage repeat business, and identify cross-selling and up-selling opportunities.

Identify high value customers to offer tailored solutions for cross- and up-selling. You can also automate highly personalised, omni-channel messages designed to help you recommend the next best financial product for each customer.

Keep your most valuable customers for longer by proactively identifying those most at risk of moving their funds or leaving your organisation. Once identified, you can deliver highly relevant messages, products, and offers that encourage them to stay, safeguarding your revenue and strengthening long-term relationships.

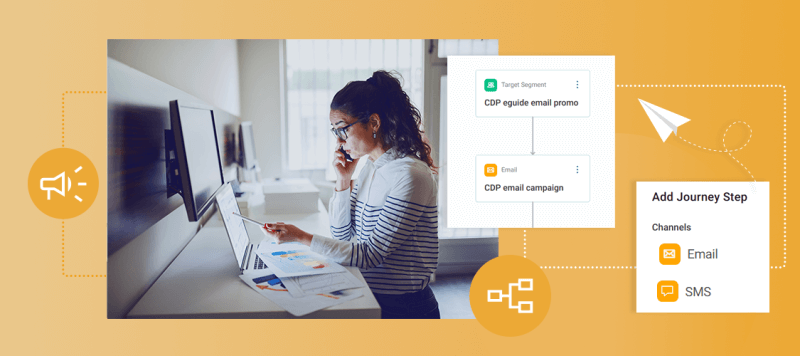

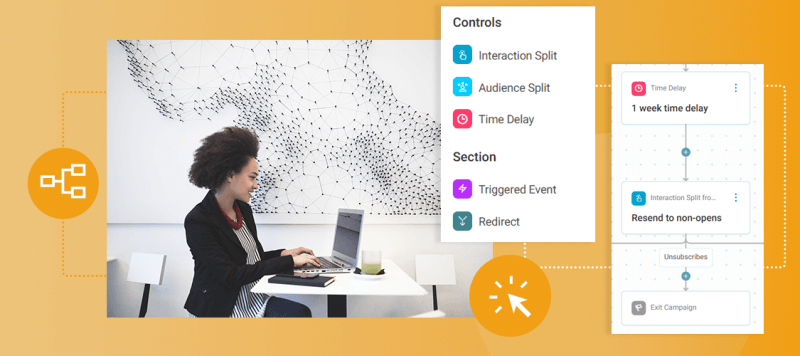

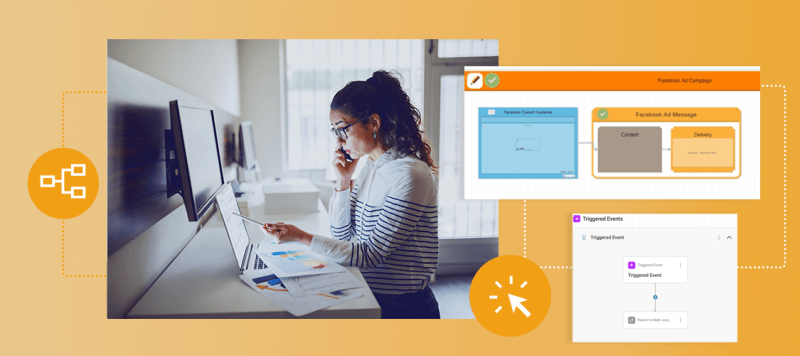

Financial decisions are often time sensitive. Orchestrate instant customer journeys across email, SMS, push, WhatsApp, and social media. Use live data triggers to engage customers with timely, relevant messages in real-time, ensuring you're always there when it matters most.

Ready to drive growth and execute smart, automated campaigns that deliver?

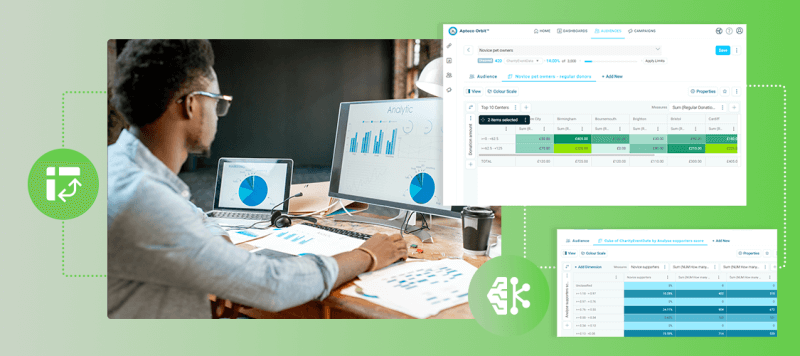

Apteco empowers marketers by giving them control over their data and campaigns. Our end-to-end capability makes it easy for you to manage your marketing from start to finish.

Discover and utilise critical customer information

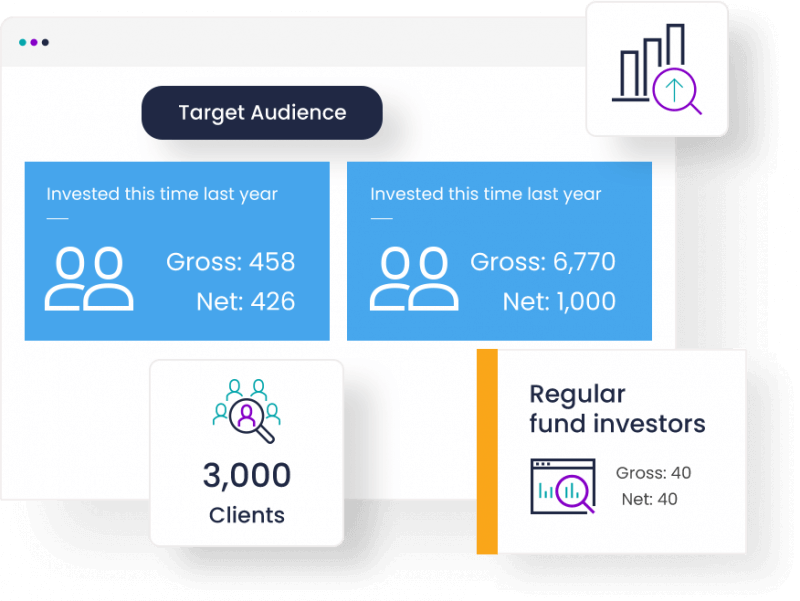

The more you understand about your customers, the better equipped you are to make informed decisions about what financial products will be attractive to them. Gathering, analysing, and segmenting your data allows you to learn how to engage and retain them as customers for longer. Identifying and pin-pointing characteristics such as behaviour type will enable you to create unique persona descriptions you can use to create useful segments within your database. You can also harness your data to develop predictive models and apply scores to each customer in your database based on the likelihood they will take up different financial products.

Elevate every customer’s journey to boost engagement

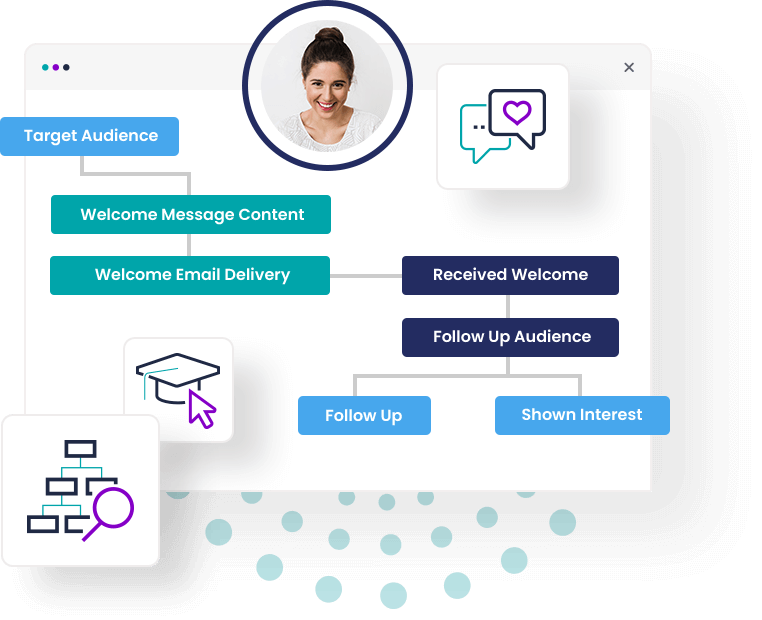

Deliver an engaging customer experience tailored to each customer from day one. By understanding your new customers better, you can craft compelling welcome journeys that smoothly guide them toward key actions, whether it's activating an account, selecting an investment fund, depositing assets, or initiating a trade. With Apteco you can customise and alter your journeys based on specific profiles to implement automated communications that welcome, onboard, and advise with ease.

Using Apteco has enabled our brand engagement activity to grow in scale, approach and ambition.

Graham Davis, Head of Marketing Strategy and Insight, Ageas

Flexible pricing bundles

Scale your insights your way - from essential dashboards to advanced analytics, precision targeting, and personalised automated campaigns.

Selector bundle

Our most basic bundle makes audience selections easy and allows users to create, refine and share target lists.

- Hosted in the Apteco Cloud

- Audience selections

- Sharing & exporting

- One starter dashboard

Analyser bundle

Powerful visualisation tools to help understand your customers and their behaviour. Includes all Selector bundle features, plus:

- Advanced selections & profiling

- Unlimited dashboards

- Email & SMS upload & response gathering

- CRM integrations

Predictor bundle

Uncover deep insights into the customer journey and discover new marketing opportunities. Includes all Selector and Analyser bundle features, plus:

- Predictive & behavioural modelling

- PWE models and lookalikes

- Best next offer & cluster analysis

- Advanced segmentation

Broadcaster bundle

Simple quick-fire campaigning. Execute single step campaigns and analyse responses.

- Single-step journey builder

- Email, SMS & social channels

- Automated CRM integration

- Response tracking

- Content personalisation

- Seeds & control groups

Campaigner bundle

Enhance customer engagement with event triggered and highly bespoke multi-step journeys. Includes all Broadcaster bundle features, plus:

- Multi-step journey builder

- Real-time triggers

- Voucher handling

- Campaign reporting & dashboards

Orchestrator bundle

Enterprise level, high powered and optimised campaigns to drive ROI across more channels. Includes all Broadcaster and Campaigner bundle features, plus:

- Campaign prioritisation & optimisation

- Automated content optimisation

- Mobile push integration

- 2 x PeopleStage instances

We play nicely with others

By integrating Apteco software with your existing applications and tools, you can get one version of the truth and operate with greater accuracy and efficiency.

From inbox to impact.

Create engaging emails and track every click, open, and conversion – with Apteco’s intuitive drag-and-drop email builder.

Supercharge your marketing with Apteco email.

Ready to boost your marketing skills?

Access a range of helpful eGuides and infographics, insightful blogs, engaging videos, webinars, and more - everything marketers in the financial sector need to sharpen their marketing skills.